Increasing Demand for Synthetic Data in the Financial Industry (9/30)

Table of Contents

Recently, the financial industry has been actively adopting AI. There is a strong movement towards building innovative services and AI-based decision-making systems by utilizing customer data. However, privacy regulations and security concerns limit the use of actual data. As a solution to this issue, the demand for synthetic data has been rapidly growing. Synthetic data is statistically similar to real data but does not contain personal information, making it a safer option. Therefore, it is being actively used across various industries, and in the financial sector, it is gaining attention as a method to minimize risks related to data utilization.

Applications and Benefits of Synthetic Data in Financial

Synthetic data can be used in various aspects of the financial industry. Firstly, it can be applied to data analysis and AI model development. For example, when developing credit scoring models or building fraud detection systems, actual data is necessary. However, using real data can be challenging due to privacy concerns. In this case, synthetic data serves as an excellent alternative, allowing high-quality model development without the risk of data breaches. Secondly, synthetic data contributes to improving customer service. For instance, when developing a chatbot for customer inquiries, synthetic data based on real conversation patterns can be used to create an advanced AI chatbot without privacy concerns.

Real-World Applications of Synthetic Data

In reality, there are already numerous cases where synthetic data is being actively adopted in the financial sector. Banks, for instance, use synthetic data to create credit scoring models based on loan application data, enabling them to conduct tests across various scenarios. Insurance companies also use synthetic data to generate different accident and claim scenarios, enhancing the accuracy of their fraud detection systems. These examples demonstrate that synthetic data can be applied in various areas of the financial industry, and the demand for it is expected to grow even further.

Considerations When Using Synthetic Data

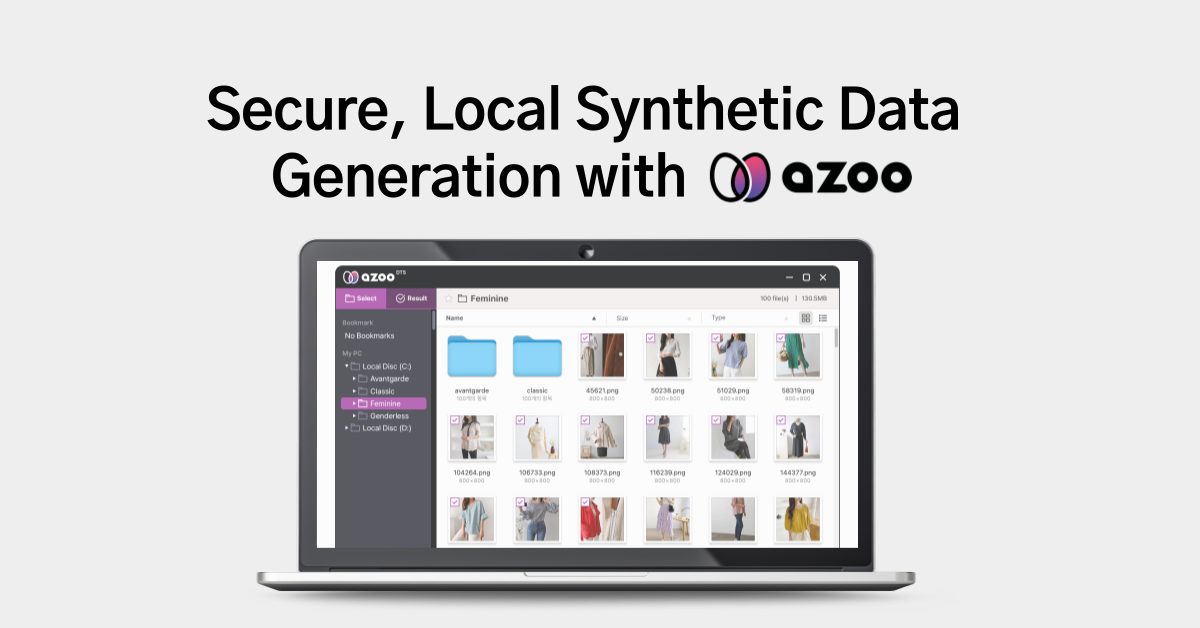

Despite the many advantages of synthetic data, there are also important factors to consider when applying it in the financial industry. Firstly, the quality and accuracy of synthetic data must be ensured. If the synthetic data is not similar enough to the real data, it can decrease the performance of AI models and lead to incorrect decision-making. Secondly, privacy regulations must be strictly followed. Although synthetic data does not contain personal information, if the characteristics of real data are overly reflected during the generation process, there is a risk of privacy breaches. The synthetic data marketplace, azoo, provides high-quality synthetic data transactions while considering these important aspects.

The Future Outlook of Synthetic Data

The demand and utilization of synthetic data in the financial industry are expected to rise even more in the future. In a financial environment where data-driven decision-making is essential, synthetic data will establish itself as a key tool that overcomes the limitations of data usage and drives innovation. Especially with the advancement of AI technologies, more sophisticated and diverse methods for generating synthetic data are being developed, which will lead to even broader applications of synthetic data services and solutions in the financial sector.

In conclusion, synthetic data accelerates digital innovation in the financial industry, enabling safe and efficient data utilization. The demand for synthetic data will continue to increase, and various financial services using this data will become even more prevalent in the future.

If you want to learn more, please visit the links!